FAQ

WHA Information Center created a video to help you navigate through the PricePoint website. It helps you get started in creating reports to review hospital charges and finding additional information on hospitals and insurance information. LEARN MORE.

Insurance and coverage can be confusing. To help ensure you get the best possible results,

we have put together the following Coverage Checklist, which includes some questions to be sure to ask

your insurance company's member services representative.

PricePoint shows you charges instead of the actual amounts you will be billed because we cannot actually know the details of your specific situation or who will be providing these services to you – and prices can vary significantly. You may have chosen to go to a specific hospital because you have had good experiences there in the past – but that hospital is not anywhere near your home town where you will be having your rehab appointments and getting your prescriptions filled. Or, maybe your condition has complicating factors and you need special equipment to help with your healing process.

It is also important to note that some of the charges displayed in PricePoint may not be covered by your insurance company.

Because there is so much variability, we have provided the statewide average charges. It isn’t perfect – but it should give you a good starting point for an informed discussion with your doctors and your insurance company.

In many cases, your payment responsibility may be less than the hospital prices shown in PricePoint. PricePoint displays several types of information that can help you determine what your actual payment responsibility will be.

Some hospitals offer financial counseling for patients. If the hospital you have selected provides this service, PricePoint displays this information. If the hospital does not provide this service, but has other financial assistance information available, this information is provided.

Health insurance may also substantially reduce your payment responsibility (the following information is also found in PricePoint).

If you do not have health insurance:

Visit the federal Exchange site at www.healthcare.gov

Information about health insurers in Wisconsin:

Health Insurance - Information for Consumers

Individual Health Insurance Carriers in Wisconsin

Out-of-Pocket Limits:

The out-of-pocket limit is the most you could pay during a coverage period for your share of the costs of covered services. Typically, a coverage period is one year, but your plan may be different.

The out-of-pocket limit typically does not apply to insurance premiums, out-of-network providers, non-preferred drugs, or any other limited or excluded services.

If you have already paid deductibles, copayments, and coinsurance during your current coverage period, those amounts would be applied toward your out-of-pocket limit.

For example:

If your health plan's out-of-pocket limit is $8,000 but you have already paid $2,500 in deductibles, copays, and coinsurance

during this coverage period, the maximum you could pay for covered services during the remainder of your coverage period is $5,500.

Even if the services displayed on your Pricing page in PricePoint total more in charges than your out-of-pocket limit, you will only be responsible for up to your out-of-pocket limit.

For example:

If your health plan's out-of-pocket limit is $8,000 but the services you selected in PricePoint show total charges of $25,000,

you will only be responsible for up to $8,000.

However, if you have already paid $2,500 toward your deductibles, copays, and coinsurance during this coverage period, the maximum you could pay for covered services during the remainder of your coverage period is $5,500 - even though the charges displayed in PricePoint are much higher.

However, if you have already paid $2,500 toward your deductibles, copays, and coinsurance during this coverage period, the maximum you could pay for covered services during the remainder of your coverage period is $5,500 - even though the charges displayed in PricePoint are much higher.

Out-of-pocket limits are designed to help you plan for your health care expenses; however, since out-of-pocket limits only apply toward covered services, it is critical that you understand which services are covered by your plan before you schedule your treatment. We encourage you to contact your insurance company with key questions covered in this Coverage Checklist.

Out-of-Pocket Limits:

The out-of-pocket limit is the most you could pay during a coverage period for your share of the costs of covered services. Typically, a coverage period is one year, but your plan may be different.

The out-of-pocket limit typically does not apply to insurance premiums, out-of-network providers, non-preferred drugs, or any other limited or excluded services.

If you have already paid deductibles, copayments, and coinsurance during your current coverage period, those amounts would be applied toward your out-of-pocket limit.

For example:

If your health plan's out-of-pocket limit is $8,000 but you have already paid $2,500 in deductibles, copays, and coinsurance

during this coverage period, the maximum you could pay for covered services during the remainder of your coverage period is $5,500.

Even if the services displayed on your Pricing page in PricePoint total more in charges than your out-of-pocket limit, you will only be responsible for up to your out-of-pocket limit.

For example:

If your health plan's out-of-pocket limit is $8,000 but the services you selected in PricePoint show total charges of $25,000,

you will only be responsible for up to $8,000.

However, if you have already paid $2,500 toward your deductibles, copays, and coinsurance during this coverage period, the maximum you could pay for covered services during the remainder of your coverage period is $5,500 - even though the charges displayed in PricePoint are much higher.

However, if you have already paid $2,500 toward your deductibles, copays, and coinsurance during this coverage period, the maximum you could pay for covered services during the remainder of your coverage period is $5,500 - even though the charges displayed in PricePoint are much higher.

Out-of-pocket limits are designed to help you plan for your health care expenses; however, since out-of-pocket limits only apply toward covered services, it is critical that you understand which services are covered by your plan before you schedule your treatment. We encourage you to contact your insurance company with key questions covered in this Coverage Checklist.

Wisconsin hospitals have led the country in their willingness to share information on the cost, quality and safety of the care they provide in their communities – making Wisconsin a national model for health care transparency.

The Wisconsin Hospital Association furthers that commitment by expanding our PricePoint website to better assist health care consumers, like you, understand the total cost of the care they receive.

PricePoint provides hospital-specific information about health care services and charges in Wisconsin – but it goes one step further by also providing information on the professional, rehabilitation, skilled nursing, ancillary and pharmacy services that may accompany the various procedures and treatments performed by the hospital. This gives you a better understanding about all the services that make up your care and how those services contribute to the charges you might see on your bill or in a report from your insurance company.

Of course, every patient is different. The actual charges will vary depending on your unique health situation, the specific providers that treat you, your insurance and any financial assistance you might receive for these services.

This means the information displayed in PricePoint should be used as a starting point for an informed discussion between you, your doctors and your insurance company.

When you get sick or injured, a lot can go into making you well again. There are many different services you may receive – some from the same doctor or hospital –

and some from several different doctors or treating facilities. You might even need medications or therapies to get you back to feeling good again.

Understanding the Services that You May Receive

With everything that goes into your care, understanding the total cost of that care can be a bit of a puzzle.

There are five basic types of services that make up the care you receive. These services are:

Since your care may require you to be formally admitted into multiple facilities, it helps to think of this category as having two parts:

Sometimes your doctor may tell you that you are being held for “observation.” Observation services are considered outpatient services because your doctor is not formally admitting you to the hospital.

Professional services include care such as visits to your primary care physician, a chiropractor or a dentist. But it also includes services like anesthesia, labs, diagnostic testing and immunizations.

Pharmacy services primarily include medications that you may receive as part of your care, but they can also include diagnostic agents – such as injections or drugs that make your body parts show up better during imaging tests like x-rays, CT scans and MRIs.

Ancillary services include services like home health visits, transportation, supplies, and medical equipment like crutches, wheelchairs, neck braces and many more.

Of course, there are always exceptions. The care you receive may not require services from every group. But understanding the services that can go into your care is a great first step in understanding what it might take to get you well or treat your injury.

The PricePoint website helps you better understand which services apply and when – and how those services contribute to the charges you may see on your bill or on a report from your insurance company. It is important to note that some of the services and charges displayed in PricePoint may not be covered by your insurance. We encourage you to talk with your insurance company about the services and charges in order to get a better idea about what your financial responsibility may be.

Understanding the Services that You May Receive

With everything that goes into your care, understanding the total cost of that care can be a bit of a puzzle.

There are five basic types of services that make up the care you receive. These services are:

-

Inpatient Services

- Hospital Inpatient Services

- Rehab and Skilled Nursing Services

- Facility Outpatient Services

- Professional Services

- Pharmacy Services, and

- Ancillary Services

Since your care may require you to be formally admitted into multiple facilities, it helps to think of this category as having two parts:

- Hospital Inpatient Services, which are formal admissions to a hospital, and

- Rehab and Skilled Nursing Services, which include formal admissions into a rehabilitation facility, a skilled nursing facility, or even a nursing home.

Sometimes your doctor may tell you that you are being held for “observation.” Observation services are considered outpatient services because your doctor is not formally admitting you to the hospital.

Professional services include care such as visits to your primary care physician, a chiropractor or a dentist. But it also includes services like anesthesia, labs, diagnostic testing and immunizations.

Pharmacy services primarily include medications that you may receive as part of your care, but they can also include diagnostic agents – such as injections or drugs that make your body parts show up better during imaging tests like x-rays, CT scans and MRIs.

Ancillary services include services like home health visits, transportation, supplies, and medical equipment like crutches, wheelchairs, neck braces and many more.

Of course, there are always exceptions. The care you receive may not require services from every group. But understanding the services that can go into your care is a great first step in understanding what it might take to get you well or treat your injury.

The PricePoint website helps you better understand which services apply and when – and how those services contribute to the charges you may see on your bill or on a report from your insurance company. It is important to note that some of the services and charges displayed in PricePoint may not be covered by your insurance. We encourage you to talk with your insurance company about the services and charges in order to get a better idea about what your financial responsibility may be.

The information provided in Pricing can help you better understand how the procedures and conditions you selected in PricePoint translate into actual health care services – and how those services contribute to the charges you might see on your bill or in a report from your insurance company.

Of course, every patient is different. The actual charges will vary depending on your unique health situation, the specific providers that treat you, your insurance, and any financial assistance you might receive for these services.

Understanding Your Results on PricePoint

It is important to note that some of the charges displayed in Pricing may not be covered by your insurance.

This means that the information displayed in PricePoint should be used as a starting point for an informed discussion between you, your doctors and your insurance company.

We’ll walk through an example Pricing page. You can follow along using your own results. While your specific data may be different, the structure will be the same.

There are two parts to the Pricing information you’ve received:

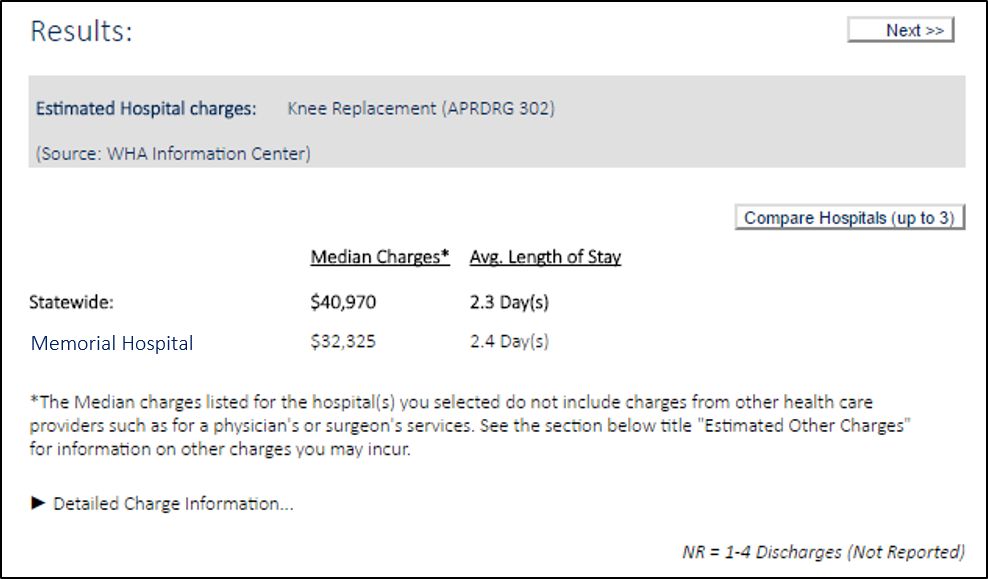

- The first part, located at the top of the Pricing page, includes the estimated hospital charges for the hospital you selected.

- The second part, located at the bottom of the Pricing page includes other services that might be needed as part of your treatment - and the estimated charges associated with those services.

The numbers shown in your Pricing information may be different, but you should be able to locate them on your Pricing page. If, your Pricing show “NR,” it means there is not enough data from this hospital for PricePoint to report on the services you are seeking.

In this section we can also see how our chosen hospital compares to other hospitals in Wisconsin. The statewide median charge and the statewide average length of stay are shown in Pricing to give you a point of reference when examining the information about the hospital you selected.

If you want to, you could use the “compare hospitals” button to select another hospital and see how its charges compare to the hospital you selected and to other hospitals statewide.

It is important to note that the charges shown are not the same as what you will pay. The amount you actually pay will vary depending on your unique health situation, your insurance, and any financial assistance you might receive for these services.

It is also important to note the charges shown in this top section of Pricing are the hospital facility charges only. These charges do not include any professional services, rehab, medications or other services that you may need. To get a better idea about the other services you might need, let’s look at the bottom section of Pricing – the section titled “Estimated Other Charges.”

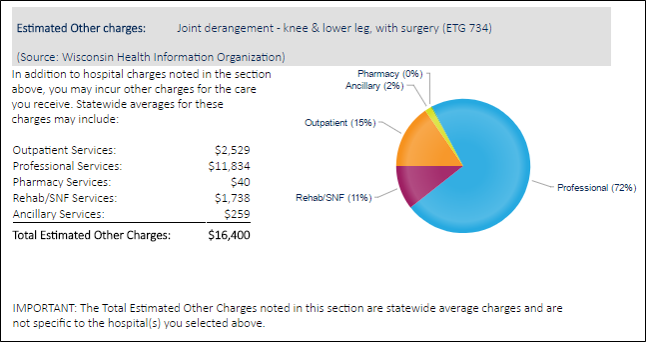

This section provides an overview of the other types of services and charges that may show up on your bill or in a report you receive from your insurance company.

It is important to note that some of these charges may not be covered by your insurance. We encourage you to talk with your insurance company about the services and charges displayed

in PricePoint in order to get a better idea about what your financial responsibility may be.

There are several types of services that are commonly needed when someone has health care. Since these services are not necessarily tied to a hospital, PricePoint provides the statewide average for these charges.

This may seem a bit confusing, but patients can receive services from a number of different rehabilitation facilities, pharmacies, laboratories and other health care professionals in conjunction with care that they receive at a hospital. Since there is no way to know for sure where you will receive each of the services you need, providing a statewide average can give you some insight into what the approximate charge may be for each service.

Let’s go back to our example. In the bottom section of the results, we can see that our example condition – a knee replacement - typically requires the following services:

- Outpatient Services,

- Professional Services,

- Pharmacy Services,

- Rehab or Skilled Nursing Facility Services, and

- Ancillary Services.

The professional services that are typically needed with a knee replacement average about $11,834 in Wisconsin. Professional services could include the services that will be performed by an anesthesiologist during surgery or services from another health care professional, like a sports medicine doctor, a primary care physician or others.

In our example, it looks like a knee replacement would require minimal charges for pharmacy services. In Wisconsin, pharmacy services for knee replacements average about $40. This typically covers any medications that may be needed or any dye that was used in an MRI or other test.

As you might expect, a knee replacement will require some rehabilitation. If these services are performed in a rehabilitation or a skilled nursing facility the average charge in Wisconsin would be about $1,738.

And, lastly, a knee replacement might require some ancillary services. This could include crutches, a wheelchair, a knee brace, or any other medical supplies. It could also include home health services or transportation services that might be needed to get to and from appointments. In Wisconsin, the average cost for ancillary services would be about $259.

In the end, the average statewide total charges for all of these other services in our example – not including the hospital facility charges in the top part of Pricing - could come to about $16,400.

But again - these are charges – not necessarily what the services cost or what you will be billed.

You might be wondering why PricePoint shows you charges instead of the actual amounts you will be billed.It is because we don’t actually know where or who will be providing these services to you – and prices can vary significantly. You may have chosen to go to a specific hospital because you’ve had good experiences there in the past – but that hospital isn’t anywhere near your home town where you’ll be having your rehab appointments and getting your prescriptions filled. Or, maybe your condition has complicating factors and you need special equipment to help with your healing process. Because there is so much variability in the costs of these services we have provided the statewide average charges. It isn’t perfect – but it should give you a good starting point for an informed discussion with your doctors and your insurance company.

The amount a hospital bills for a patient’s care is known as the charge. This is not the same as the actual cost or amount paid for the care. The amount collected by a hospital for each service is almost always less than the amount billed. There are three common examples:

- Government programs such as Medicare, Medicaid, BadgerCare and General Relief typically pay health care providers much less than the billed charge. These payments are determined by government agencies. Hospitals have no ability to negotiate reimbursement rates for government-paid services.

- Commercial insurers or other purchasers of health care services usually negotiate discounts with hospitals on behalf of the patients they represent.

- Hospitals typically have policies that allow low-income persons to receive reduced-charge or free care.

There are many reasons that charges may differ between hospitals. Among them are the following:

Payer mix – As with other businesses, hospitals cannot survive if costs exceed revenues over a long period of time. Government programs (like Medicare, Medicaid, BadgerCare and General Relief) generally reimburse hospitals at rates that do not cover the costs they incur to provide care. Therefore, hospitals that have a relatively high percentage of government-program patients must recover a greater percentage of their operational costs from privately insured and self-pay patients through higher charges.

Hospital cost structures – Hospitals differ in their approach to pricing based on operational costs. Some hospitals try to spread the cost of all services and equipment among all patients. Others establish charges for specific services based on the cost to provide each specific service. Furthermore, some hospitals may decide, or be required, to provide certain services at a loss while other hospital operations subsidize the losses. Any of these situations can result in significantly different charges among hospitals for a given type of service.

New technology - The equipment hospitals use to provide services differs in age, sophistication, and frequency of use.

Staffing costs - Salary scales may differ by region and are typically higher in urban than rural areas. Shortages of nurses and other medical personnel may affect different regions differently. Where shortages are more severe, staffing costs, and, therefore charges, may be higher.

Intensity of care - Some hospitals are equipped to care for more severely ill patients than others. Patients within the same diagnosis or procedure category may need very different levels of service and staff attention, causing variation in charges.

Range of services provided - Hospitals differ in the range of services they provide to patients. Some may provide the full range of services required for diagnosis and treatment during the stay. Others may stabilize patients and then transfer them to another hospital for more specialized or rehabilitative care.

Service frequency – The per-patient cost of services is generally higher if the type of hospitalization occurs infrequently at the hospital. Furthermore, a single case with unusually high or low charges can greatly affect a hospital’s average charge if the hospital reported only a few cases in a given time period.

Differences in coding - Hospitals vary in their coding systems and personnel and in the number of billing codes they routinely include on a billing form. This may result in similar types of hospitalizations being classified differently.

Capital expenses - Hospitals differ in the amount of debt and depreciation they must cover in their charge structure. A hospital with a lot of debt may have higher charges than a hospital not facing such expenses. Furthermore, hospitals may choose to lease or purchase equipment or hospitals. The choices made about financing of capital projects may affect charges in different ways.

|

All of the hospital-related data found on PricePoint is collected and published by the WHA Information Center (WHAIC). WHAIC is a wholly owned subsidiary of the Wisconsin Hospital Association. WHAIC was

incorporated on October 1, 2003, and began collecting data in January 2004 under a contract with the Wisconsin Department of Administration. WHAIC has collected and disseminated complete, accurate, and

timely data about charges and services provided by Wisconsin hospitals and ambulatory surgery centers since 2004. Pursuant to Chapter 153, Wisconsin Statutes, all Wisconsin hospital and surgery centers are required to submit inpatient and outpatient data to WHA Information Center (WHAIC) each quarter. PricePoint uses this data to provide health care consumers with hospital-specific information about health care services and charges in Wisconsin. For more information on the WHA Information Center, please visit the WHAIC website (whainfocenter.com) |

|

PricePoint also uses data provided by the Wisconsin Health Information Organization (WHIO) to provide health care consumers with information related to professional, rehabilitation, skilled nursing, ancillary, and

pharmacy services that are not part of the hospital facility charges included with the WHAIC data. WHIO aggregates commercial, Medicare Advantage and Medicaid claims data to provide the information used in PricePoint. For information about the Wisconsin Health Information Organization, please visit the WHIO website (wisconsinhealthinfo.org |

| PricePoint was produced in part by using computer software created, owned and licensed by the 3M Company. All copyrights in and to the 3M™ APR DRG Software, and to the 3M™ APR DRG Classification System(s) (including the selection, coordination and arrangement of all codes) are owned by 3M. All rights reserved. |

If your Pricing information shows "NR", it means that there is not enough data from this hospital for PricePoint to report on the services you are seeking.

If your Pricing information shows $0, it means the facility does not provide this service.